ALEXANDRIA, Va. – Convenience store sales surged over the first half of the year as lower gas prices fueled more driving and Americans embraced the continued addition of fresh and healthy food options, according to a NACS survey.

More than two in three convenience retailers (70%) say that in-store sales in the first half of 2016 were higher than the same period last year. A majority (54%) also say that fuel sales were higher compared to the first half of 2015. Only 8% of retailers say that in-store sales were lower in the first half of 2016 compared to a year ago.

Retailers continue to add fresh items to their product mix: 43% say that they have added more fresh fruit or vegetables this year; 39% have added more packaged salads; and 30% have added more cut fruit and vegetables. Overall, 85% of retailers say they sell fresh fruit or vegetables, an 8-point increase over last year.

Retailers also are selling more prepared foods and see foodservice as a growth opportunity: 64% say that they are confident in their ability to compete with quick-service restaurants for customers.

Golden Pantry Food Stores (Watkinsville, Ga.) and Flash’s C-Store (Sheridan, Wyo.) are among the many companies that say they are adding more prepared foods and fresh fruit and salads. Meanwhile, SpartanNash (Grand Rapids, Mich.), which operates Quick Stop convenience stores, is expanding its nuts and seeds, jerky and protein bar selections. Overall, 94% of retailers surveyed say they sell health bars and 92% sell nuts and trail mix.

“It’s not a matter of ‘if’ we are going to evolve; it’s a requirement,” said Dennis McCartney with Landhope Farms Corp. (Kennett Square, Pa.), which is investing in new foodservice equipment to add new items to its menu.

Meanwhile, bottled water sales continue to grow at convenience stores. Nearly half of all retailers (48%) say they have expanded their bottled water offerings, and even more (59%) say they increased their nutraceuticals and enhanced water selections. Convenience stores sell an estimated 50% of all single-serve bottled water purchases in the United States.

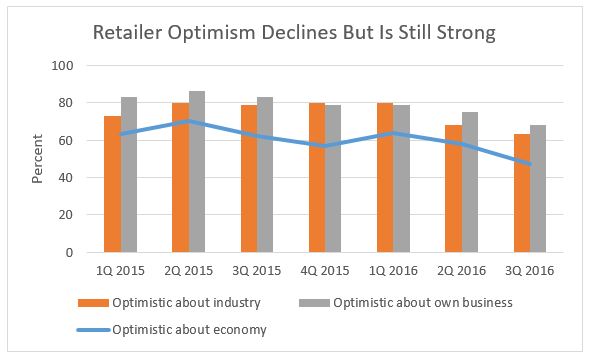

As a result of strong sales and continued success selling new items, more than two in three convenience retailers (68%) say they are optimistic about their own business prospects, and 63% are optimistic about the industry’s prospects. Sales this summer are expected to be strong because of “dry, hot weather and tourist traffic,” noted Rich Spresser with Pester Marketing (Denver, Colo.).

However, there are areas of concern. Retailer optimism over their own business prospects, while still strong, has dropped 20 points from the 83% who said they were optimistic a year ago.

The drop in optimism is led by bigger concerns about the economy. A minority of retailers (47%) now say they are optimistic about the overall U.S. economy, down from 61% a year ago. Retailers say they are apprehensive about regulations, especially those targeting wages, which could lead to higher direct store operating expenses.

Why the downward trend in overall optimism? The most common reason is summed up by Robin Gabriel with Shell Food Mart (Hinsdale, Ill.): “The election” and the overall negative political climate.

The quarterly NACS Retailer Sentiment Survey tracks retailer sentiment related to their businesses, the industry and the economy as a whole. A total of 110 member companies, representing a cumulative 1,905 stores, participated in the June 2016 survey.