By Mike Watkins

LONDON—With most countries in Europe lifting pandemic restrictions by the end of Q1 2022, shoppers started to return to stores, and as shoppers became less dependent on large store formats for the weekly shop, the impact was more visits to convenience stores.

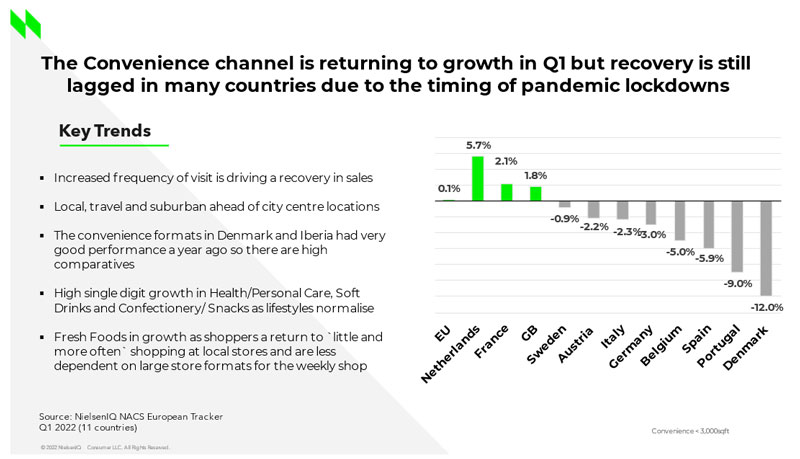

Across Europe, the channel growth was +0.1% compared with a 2.3% fall in sales in Q4 2021. However, the recovery lagged in some countries, particularly in Belgium, Denmark and Iberia, with unusually cold weather and historic snowfall in Spain a year ago also benefiting convenience stores. (NielsenIQ European Strategic Planner 11 countries include: Austria, Belgium, Denmark, France, Great Britain, Germany, Italy, Netherlands, Portugal, Spain, Sweden.)

Local, travel and suburban stores are seeing a normalization of sales quicker than city center locations, and in Great Britain, the underlying momentum in convenience stores is strongest with the channel growth outperforming supermarkets for eight consecutive months.

As lifestyles slowly return to normal, the fastest growing super categories in European convenience stores in Q1 were health and personal care (+16%), soft drinks (+8%), fresh foods (+5%) and confectionery and snacks (+4%).

However, with accelerating inflation from rising energy, travel and food costs, shoppers are already starting to change how they shop, and as the cost-of-living squeeze accelerates, shoppers are likely to shop less often at large stores and may instead spend more in smaller formats with smaller ranges to help manage household budgets.

And with fuel prices increasing shoppers may choose to use their cars less, which may reduce the number of top-up shops, but this may be compensated for with increased working from home, and so more spend locally.

So, while the FMCG industry is more insulated from any downturn in consumer expenditure, no retail format is immune to the “shelf shock” from the biggest increases in European food prices in over 25 years.

Mike Watkins is head of retailer and business insight UK, NielsenIQ.