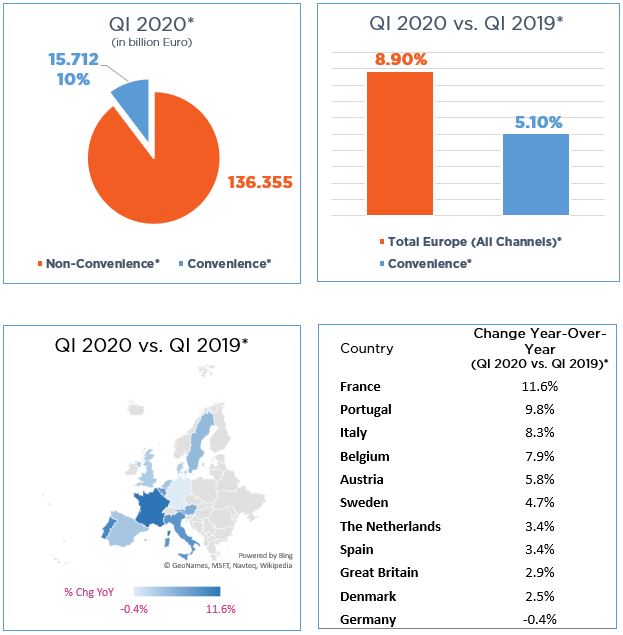

Size and Development of the Western European* Convenience Market

* Source: Nielsen NACS European Convenience Tracker.

Commentary

At the end of March 2020, across all of the countries covered by the Nielsen NACS European Convenience Tracker, shopping habits for food and drink changed significantly, and in some channels, perhaps irreversibly due to the disruption following the start of the COVID-19 pandemic.

During Q1 2020 across Europe (Austria, Belgium, Denmark, France, Great Britain, Germany, Italy, Netherlands, Portugal, Spain, Sweden), total food and drink and tobacco sales accelerated to +8.9% and in the convenience channel by +5.1% as shoppers prepared for the restricted living that commenced early March.

The impact was a massive surge of sales across the industry (peaking at over +30% for two weeks in mid-March in the “Big 5” European countries) and a shift in purchasing away from all small store formats, including convenience, and toward supermarkets and large superstores. The forecourt channel was further hit by national travel restrictions. Nevertheless, the convenience channel did remarkably well during this time as shoppers made more visits to more stores for their FMCG shopping. With significant disruption to global and national supply chains, shoppers found convenience stores (many with local suppliers) both accessible and convenient. During the quarter, convenience growth was highest in France at +11.6%, where the lockdown restricted shopping trips to just a 1 kilometer radius in most of the country, lower in Great Britain (+2.9%) due to the shift to out-of-town stores and online at the end of March, and flat in Germany (-0.4%), where supermarkets gained market share.

Social distancing is the new norm for the foreseeable future, and the early indications are that we are now seeing the start of a fundamental change in shopping behaviour that will last well beyond 2020. With a delayed and slow restart of the out-of-home food and beverage industry, with possibly less consumption and probably less travel, convenience retailers will need a different exit strategy from lockdown than supermarkets. This should include a fundamental review of the use of space and range to take advantage of the emerging consumer trends that Nielsen is seeing, in particular around safety, integrity, provenance, simplicity and—with a recession on the horizon in Q2—value for money.

© Nielsen 2020; Western Europe data from: Austria, Belgium, Denmark, France, Great Britain, Germany, Italy, The Netherlands, Portugal, Spain, Sweden; defined channel selection per country; defined food & near food supercategories.

Disclaimer: This information is provided for the sole use by NACS and any member of NACS is required to obtain express permission in the form of a third party agreement from Nielsen if it wishes to make any other disclosures of the materials.