Over the summer, shoppers across Europe adapted to new shopping routines necessary due to the pandemic, and most countries reverted back to messages about limiting unnecessary travel, keeping offices closed and placing restrictions on out-of-home eating and drinking.

While growth slowed from +13% in Q2 at the height of lockdown, there was no significant shift of spend back to the hospitality industry. Food retail growth remained strong.

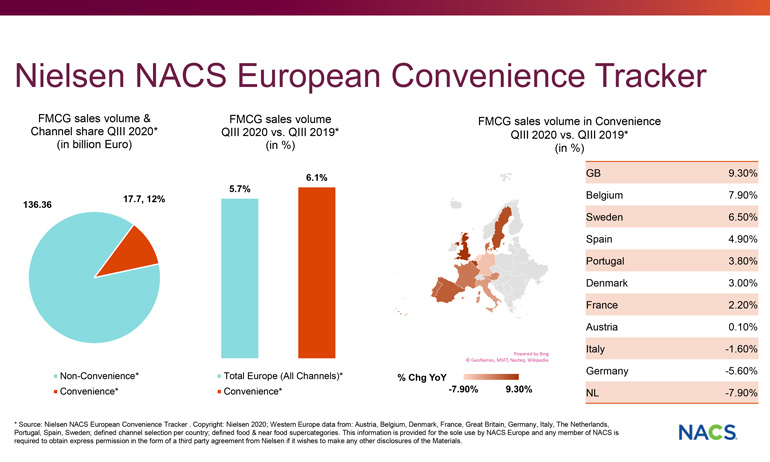

The topline European growth across all channels covered by the Nielsen NACS European Convenience Tracker in the three months to the end of September was +5.7%, with convenience stores holding the recent gains in market share (11.5% of all channel sales in Europe) with a growth in sales of +6.1%.

Sunny weather in Northern Europe in August had a positive impact on sales at convenience stores, and while sales did slow a little in September, the key trends of the past six months—a shift to online, fewer visits to stores, double-digit growth in spend per visit and more spend at local shops—all continued.

Online was the fastest growing channel in the U.K., France, Italy and Spain, with much of the incremental sales taken from superstores and hypermarkets, but shoppers remained considered in their shopping trips, also buying extra items at convenience stores to help reduce unnecessary journeys.

Across the region, convenience store growth was the highest in the U.K. (+9.3%), Belgium (+7.9%) and Sweden (+6.5%). The fastest growing categories in convenience stores were once again alcohol (+21% and ahead of the +13% seen across all channels in Europe) and also homecare (+9%) as shoppers used convenience stores as alternatives to an out-of-town trip.

The change in lifestyles is also reflected in category purchasing. For example, fresh pizza grew by 8% across convenience stores in Europe to become the second biggest contributor to the sales of the fresh/chilled supercategory after milk. In addition, sales of fresh meat grew by 9%, and the sales of gin increased by 34%!

Helped by summer weather, sales of non-alcoholic beverages were better, and while down 2% over last year, improved on a poor Q2. The strong growth in frozen thawed to +2.5% because of ice cream sales impacted by less travel, and packaged grocery growth slowed to +3.2% as households de-stocked these categories. However, the steep decline in health and personal care continued (-8%), which is a macro trend across all channels and all retailers.

Overall, food retail sales are still being helped by households working from home and the continued restrictions placed on hospitality—disruptions that are expected to continue for the foreseeable future—and we can anticipate topline growth being maintained in Q4 as limitations on household mixing and movement are extended again in all European countries.

The changes in shopper behaviour seen over the past nine months are semi-permanent, and for many convenience stores, the loss of urban and commuting spend will continue to be compensated for by increased spend near home, as sales shift to neighbourhood retailers and the suburbs and away from city centres.

And, as we have seen all year, there is an underlying trend for shoppers to buy products produced locally, sourced locally and to shop locally.