Size and Development of the Western European* Convenience Market

* Source: Nielsen NACS European Convenience Tracker.

There was a massive change in shopping behaviour across all of the countries covered by the Nielsen NACS European Convenience Tracker in the three months to the end of June. As countries entered economic lockdown and social distancing became the norm, the number of shopping trips fell dramatically, typically 20% or more, and FMCG basket spends surged by up to 30% in many countries. There was a shift in sales away from stores to online—the channel doubled in size in the U.K. to over E12b per annum, which alongside France is the largest online fmcg market in Europe—and many millions of shoppers used online for the first time.

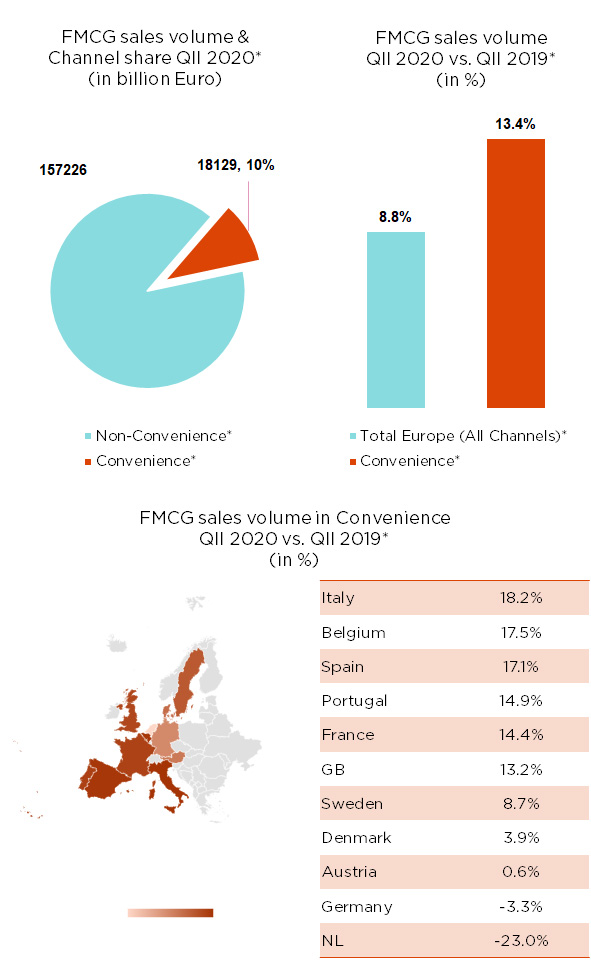

However, brick and mortar still account for around 95% of fmcg sales in Western Europe, and whilst larger supermarkets gained sales at the start of ‘lockdown,’ sometimes at the expense of discounters, sales in the convenience channel increased +13.4 % over the quarter and ahead of the total market at +8.8%.

There are two reasons for this strong growth. Shoppers quickly adapted to a new routine of using safe, secure and convenient food and drink stores where it was possible to do a weekly shop locally, without the need for uneccessary travel. Sales in the convenience channel also benefited from households working from home and the closure of the hospitality sector.

Across the region, convenience store growth was the highest in Italy (+18.2%), Belgium (+17.5%) and Spain (+17.1 %), with strong growth in France (+14.4%) and the U.K. (+13.2%) (footnote1). The fastest-growing categories were Alcohol (+39%), Frozen (+31%), Homecare (26%) and Ambient Grocery (+23%).

However, with change in the lifestyle of households, sales of Soft Drinks and Confectionery were flat or in slight decline, and sales fell steeply in Health and Personal Care, trends which were mirrored across other channels.

Looking ahead, we expect shoppers to remain focussed on limiting shopping occasions and buying what they need faster and prioritising easy and smarter shopping. Whilst this will benefit online retailers, convenience stores that are using technology to minimise touchpoints, such as ‘scan and go,’ cashless payment and mobile apps are equally well placed. Stores that are convenient, perceived as safe, socially responsible and are supporting the local community will thrive even with the impact of the forthcoming recession. And some also may be able to capitalise on the other fast-growing trend, that of food delivery where eating in has become the new eating out.

Shoppers have been forced to change habits due to the pandemic. With the emergence of a new ‘at home’ family meal occasion, the growing importance of provenance, a focus on health and well-being, as well as the adoption of new technology, these are trends that should help sales grow in the convenience sector.

© Nielsen 2020; Western Europe data from: Austria, Belgium, Denmark, France, Great Britain, Germany, Italy, The Netherlands, Portugal, Spain, Sweden; defined channel selection per country; defined food & near food supercategories.

Disclaimer: This information is provided for the sole use by NACS and any member of NACS is required to obtain express permission in the form of a third party agreement from Nielsen if it wishes to make any other disclosures of the materials.